how much tax on death

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the. Thats 40 cents of every dollar you transfer.

California Property Death Tax Vote To Repeal Only 11 Days Left To Repeal Youtube

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death.

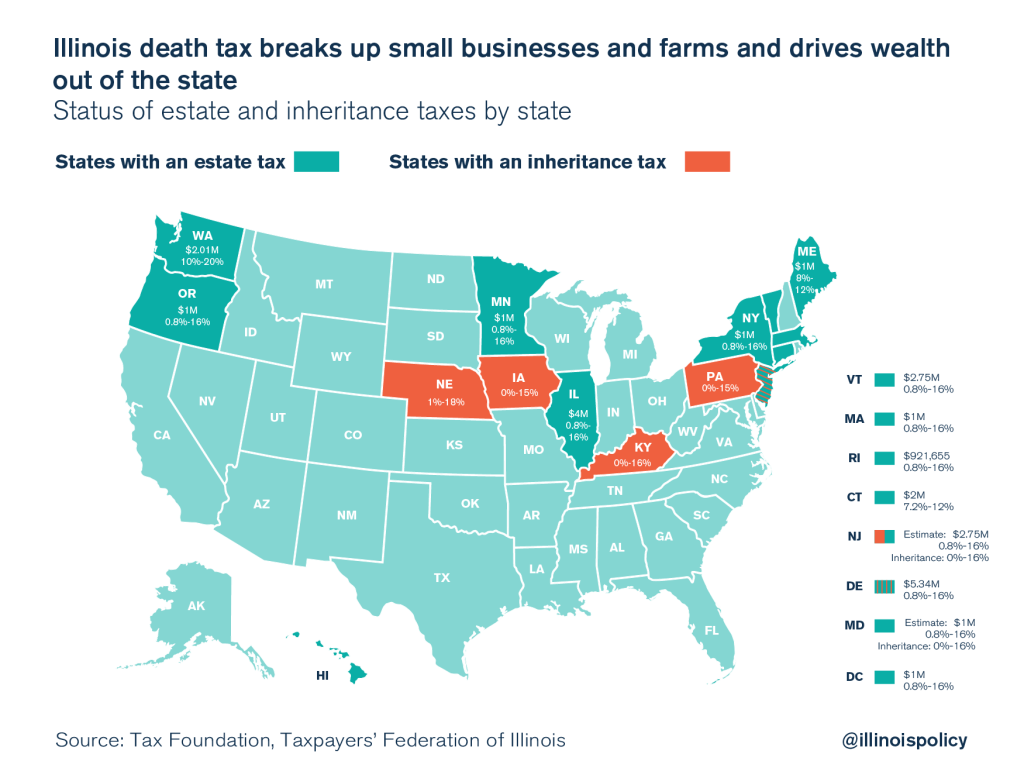

. Federal exemption for deaths on or after January 1 2023. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. Only 12 states plus the District of Columbia impose an estate.

Youll also need that form if the estates gross. There is a Federal estate tax that applies to estates worth more than 117 million. Code Section 2001 also known.

Inheritance Tax is a tax on the estate the property money and possessions of someone whos died. All the people who lie in the 2020-21 tax year have a tax allowance of 325000 the nil rate band and the tax-free inheritance. The Estate and Gift Tax rates are found under 26 US.

Every taxpayer has a lifetime estate tax exemption. Inheritance tax is imposed on the assets inherited from a deceased person. The truth is that most people will never have to worry about the federal estate tax often called the death tax In fact less than 01 of all the people who passed away in 2018.

2000000 in 2006 - 2008. While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes. Notice that those percentages jump up pretty quickly.

The tax rate on. On the federal level the portion of the estate that surpasses that 1170 million and 1206 million cutoffs will be taxed at a rate of 40 as of 2021 and 2022 respectively. The death benefit from a life insurance policy can help your family pay for your final expensesthings like transportation embalming a casket.

Theres normally no Inheritance Tax to pay if either. The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death. Take a look at the chart one more time.

Its the same ever since 2010. The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or. The value of your estate is below the.

Some states and a handful of federal governments around the world levy this tax. No not every state imposes a death tax. Any resulting capital gains are 50 taxable and added to all.

Estate and gift taxes the. 3500000 for decedents dying in 2009. If the deceased person is leaving a taxable estate you must file Form 1041.

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. Income Tax Return for Estates and Trusts. How Much is the Death Tax.

1 day agoFinancial Benefits of Life Insurance.

Top Ten Reasons The U S House Will Kill The Death Tax

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Tax Refunds Becoming Much More Digital Pymnts Com

Focus Shifts To State Estate Tax Planning Wsj

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Top Ten Reasons The U S House Will Kill The Death Tax

Paying Taxes On A Home Sold After A Spouse S Death Kiplinger

Death Tax Who Pays How Much Comprehensive Guide Inside

The Generation Skipping Transfer Tax A Quick Guide

What Is A Death Tax And Will You Have To Pay One Fox Business

Nj Division Of Taxation Inheritance And Estate Tax

Where Is My Tax Money Spent A Visual Guide Fiscal Fizzle

Democrats Bring Back Death Tax Small Businesses And Family Farms Crushed

Estate Tax Definition Tax Rates Who Pays Nerdwallet

If I Die In Ca In 2014 How Much Can I Own Without Paying Death Taxes Law Office Of James F Roberts Associates Apc

Death Bitcoin And Taxes A Guide To Post Life Crypto The Hustle